Optical networking market in rude health

Wednesday, June 15, 2011 at 8:14AM

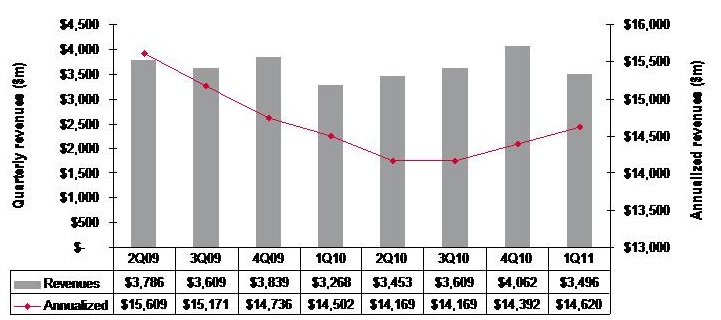

Wednesday, June 15, 2011 at 8:14AM  Quarterly market revenues, global optical networking (1Q 2011). Source: Ovum

Quarterly market revenues, global optical networking (1Q 2011). Source: Ovum

Despite recent falls in optical equipment makers’ stock, the optical networking market remains in good health with analysts predicting 6-7% growth in 2011.

For Andrew Schmitt, directing analyst for optical at Infonetics Research, unfulfilled expectations are nothing new. Optical networking is a market of single-digit yearly growth yet in the last year certain market segments have grown above average: spending on ROADM-based wavelength division multiplexing (WDM) optical network equipment, for example, has grown 20% since the first quarter of 2010.

“Every few years people get this expectation that there is going to be this hockey stick [growth] and it is not,” says Schmitt. “There has been a lot of Wall Street money moving into this sector in the latter part of 2010 and first part of this year and they have just had their expectations reset, but operationally the industry is very healthy.”

“Nothing in this business changes quickly but the pace of change is starting to accelerate”

Andrew Schmitt, Infonetics Research

But Schmitt acknowledges that there is industry concern about the market outlook. “There have been lots of client calls in the first half of the year wanting to talk numbers,” says Schmitt. “When the market is growing rapidly there is no need for such calls but when it is uncertain, customers put more time into understanding what is going on.”

Both Infonetics and market research firm Ovum say the optical networking market grew 7% globally in the last year (2Q10 to 1Q11).

Ovum says the market reached US $3.5bn in the first quarter of 2011 and it expects 6% growth this year. “Most of the growth will come from North America—general recovery, stimulus-related spending, and LTE (Long Term Evolution)-inspired spending; and from South and Central America mostly mobile and fixed broadband-related,” says Dana Cooperson, network infrastructure practice leader at Ovum.

Ovum also notes that optical networking annualised spending for the last four quarters (2Q10-1Q11) finally went into the black with 1% growth, to reach $14.6bn. Annualised share figures are a strong indicator of longer-term market trends, says Ovum.

Market growth

Factors accounting for the growth include optical equipment demand for mobile and broadband backhaul. Carriers are also embarking on a multi-year optical upgrade to 40 and 100 Gigabit transmission over Optical Transport Network (OTN) and ROADM-based networks. Infonetics notes that ROADM spending in particular set a new high in the first quarter, rising 4% sequentially.

Ovum expects overall growth to come from metro and backbone WDM markets and from LTE. “For metro it is a combination of new builds, as DWDM continues to take over the metro core from SONET/SDH, and expansions of ROADM and 40 Gigabit,” says Cooperson. “For backbone it is a combination of retrofits for 40 and 100 Gigabit and overbuilds with 40 and 100 Gigabit coherent-optimised systems.”

Many operators are also looking at OTN switching and how it can help with network efficiency and manageability, she says, while mobile backhaul continues to be a hot spot as well at the access end of the network.

The Americas are the regions accounting for market growth whereas in Asia-Pacific and Europe, Middle East and Africa the spending remains flat.

“We’re not as bullish on Europe as I’ve heard some others are,” says Cooperson. “We expected China to slow down as capital intensities in the 34-35% seen in 2008 and 2009 were unsustainable. We saw the cooling down a bit earlier in 2010 than we had expected, but it did cool down and will continue to.”

Ovum expects Asia-Pacific as a whole to be moribund. But at least the pullbacks in China will be countered by slow growth in Japan and a big upsurge in India after a huge decline last year due to delayed 3G-related builds among other issues.

Outlook

Ovum is optimistic about the optical networking market due to continued competitive pressures and traffic growth. “We don’t think traffic growth can just continue without attention to the underlying issues related to revenue pressure, regardless of competitive pressures,” says Cooperson. “But newer optical and packet systems offer significant improvements over the old in terms of power efficiency, manageability, and of course 40 and 100 Gigabit coherent and ROADM features.”

“Most of the growth will come from North America"

Dana Cooperson, Ovum.

Many networks worldwide are also due for a core infrastructure update to benefit capacity and efficiency while many other operators are upgrading their access networks for mobile backhaul and enterprise Ethernet services.

Schmitt stresses that while it is right to talk about a 'core reboot', there are all sorts of operators that make up the market: the established carriers, those focussed on Layer 2 and Layer 3 transport, dark fibre companies and cable companies.

“Everyone has a different business so there is not a whole lot of group-think in this industry,” says Schmitt. “So when you talk about a transition to 40 and 100 Gigabit, some carriers will make that transition earlier than others because the nature of their business demands it.”

However, there are developments in equipment costs that are leading to change. “Once you get out to 2013-14, 100 Gigabit [transport] looks really good relative to 40 Gigabit and tunable XFPs at 10 Gigabit look really, really good,” says Schmitt, who believes these are going to be two dominating technologies. “People are going to use 100 Gigabit and when they can afford to throw more 10 Gigabit at the [capacity] problem, in shorter metro and regional spans, they will use tunable XFPs,” he says. “That is a whole new level in terms of driving down cost at 10 Gigabit that people haven’t factored in yet.”

Pacier change

The move to 100 Gigabit will not lead to increased spending, stresses Schmitt. Rather its significance is as a ‘mix shift’: The adoption of 100 Gigabit will shift spending from older systems to newer ones so that the technology is interesting in terms of market share shift rather than by growing overall revenues.

That said, there are areas of optical spending where capital expenditure (capex) is growing faster than the single-digit trend. These include certain competitive telco providers and dark fibre providers like AboveNet, TimeWarner Telecom and Colt. “You look at their capex year-over-year and it is increasing in some cases more over 20% a year,” says Schmitt.

He also notes that while the likes of Google, Yahoo, Microsoft and Apple do not spend on optical equipment as much as established operators such as Verizon or AT&T, their growth rate is higher. “There are sectors of the market that are growing quickly, and competition that are positioned to service those sectors successfully are going to see above-trend growth,” says Schmitt.

He highlights three areas of innovations - ‘big vectors’- that are going to change the business.

One is optical transport's move away from simple on-off keying signalling that opens up all kinds of innovation. Another is the shift in the players buying optical equipment. “A lot more of the R&D is driven by the AboveNets, Time Warners, Comcasts and the Googles and less by the old time PTTs,” says Schmitt. “That is going to change the way R&D is done.”

The third is photonic integration which Schmitt equates to the very early state of the electronics business. While Infinera has done some interesting things with integration, its latest 500 Gigabit PIC (photonic integrated circuit) is a big leap in density, he says: “It will be interesting if that sort of technology crosses over into other applications such as short- and intermediate-reach applications.”

“Nothing in this business changes quickly but the pace of change is starting to accelerate,” says Schmitt. “These three things, when you throw them together in a pot, are going to result in some unpredictable outcomes.”

100G,

100G,  AboveNet,

AboveNet,  Andrew Schmitt,

Andrew Schmitt,  Colt,

Colt,  Dana Cooperson,

Dana Cooperson,  Infinera,

Infinera,  Market analysis,

Market analysis,  OTN,

OTN,  PIC,

PIC,  ROADM,

ROADM,  Time Warner Telecom in

Time Warner Telecom in  market research

market research  Print Article

Print Article

Reader Comments (6)

So what will be different about R&D if AboveNet, Google, and cablecos are driving it rather than the big telcos? Also, as I wondered in an article I recently wrote on the 10x10 MSA, are Google and its high-end data center ilk big enough on their own to warrant spending precious R&D dollars to chase?

Well the article is a bit boring really. So we are growing single digits and there are some technology shifts.

How does the massive growth in wireless relate to optical? Is Infinera the leader in this new higher density? What about NeoPhotonics, Fabrinet, etc.

AboveNet is mentioned a couple times but are they interesting or not? How exactly is R&D going to change and what are the implications?

The article starts with kind of a ho hum basis and then raises some questions without answering anything.

Stephen - I think equipment lifecycles will shrink and we will see more emphasis on L2+L0 equipment - and R&D will need to adjust to accommodate this. There will be more re purposing of Enterprise components and equipment.

I don't think the high end data center folks are big enough to warrant R&D specifically targeted at their needs, though they will try to convince people otherwise.

Stephen, you ask a great question and I see Andrew has replied. I can only comment about Google but I learnt that they want three 100G technologies: the 2km 10x10 MSA, a mid-range metro technology based on direct detection and 100 Gigabit coherent technology.

There are companies that are willing to back the metro requirement as there are the 10x10 MSA as meeting these requirements promise them an important customer but whether it benefits the marketplace overall only time will tell. My view is that having the likes of a Google with its additional requirements only benefits the industry.

Kris, the article is the result of two press releases from Ovum and Infonetics Research about the latest optical networking quarterly numbers. I thought it would be good to discuss the state of ON and to get some more detail about this last quarter. It also was a good opportunity to get the two analysts’ view regarding what the rest of the year will look like, and their views on some of the important trends.

I thought Andrew Schmitt’s three big vector trends and the fact that it is all too easy to assume that it is the large PTTs that are driving the industry as important and interesting observations.

I’m sorry if you thought the article boring but am grateful for the feedback. I can always do a better job.

Roy: I've had several systems vendors talk to me about alternative modulation formats for 100G, but with the exception of the systems Ciena supplied to NYSE:Euronext (which I believe were specific to that customer), talking is as far as anyone has gotten, to my knowledge. I have to think they're coming, but I can't say I know how long Google and others will have to wait for them.

@Stephen: I can't say I know how long Google and others will have to wait for them

May want to check your sources, but I have been told that Google is already the largest deployer of 100G wavelengths.