Part 2: Tunable laser market

"The tunable laser market requires a lot of patience to research." So claims Vladimir Kozlov, CEO of LightCounting Market Research. Kozlov should know; he has spent the last 15 years tracking and forecasting lasers and optical modules for the telecom and datacom markets.

Source: LightCounting, Gazettabyte

Source: LightCounting, Gazettabyte

The tunable laser market is certainly sizeable; over half a million units will be shipped in 2014, says LightCounting. But the market requires care when forecasting. One subtlety is that certain optical component companies - Finisar, JDSU and Oclaro - are vertically integrated and use their own tunable lasers within the optical modules they sell. LightCounting counts these as module sales rather than tunable laser ones.

Another issue is that despite the development of advanced reconfigurable optical add/ drop multiplexers (ROADMs) and tunable lasers, the uptake of agile optical networking has been limited.

"Verizon is bullish on getting the next generation of colourless, directionless and contentionless ROADMS to reconfigure the network on-the-fly," says Kozlov. "But I'm not so sure Verizon is going to be successful in convincing the industry that this is going to be a good market for [ROADM] suppliers to sell into."

Reconfigurability helps engineers at installations when determining which channels to add or drop, but there is little evidence of operators besides Verizon talking about using ROADMS to change bandwidth dynamically, first in one direction and then the other, he says.

Another indicator of the reduced status of tunable lasers is NeoPhotonics's intention to purchase Emcore's tunable external cavity laser as well as its module assets for US $17.5 million. Emcore acquired the laser when it bought Intel's optical platform division for $85 million in 2007, while Intel acquired it from New Focus in 2002 for $50 million. NeoPhotonics has also spent more in the past: it bought Santur's tunable laser for $39 million in 2011.

"There was so much excitement with so many players [during the optical bubble of 1999-2000], the market was way too competitive and eventually it drove vendors to the point where they would prefer to sell the business for pennies rather than keep it running," says Kozlov. "Emcore has been losing money, it is not a highly profitable business." Yet for Kozlov, Emcore's tunable laser is probably the best in the business with its very narrow line-width compared to other devices.

Tunable laser market

Tunable lasers have failed to get into the mainstream of the industry. "If you look at DWDM, I'm guessing that 70 percent of lasers sold are still fixed wavelength or temperature-tunable over a few wavelengths," says Kozlov. System vendors such as Huawei and ZTE advertise their systems with tunable lasers. "But when we asked them how they are using tunable lasers, they admitted that the bulk of their shipments are fixed-wavelength devices because whatever little they can save on cost, they will."

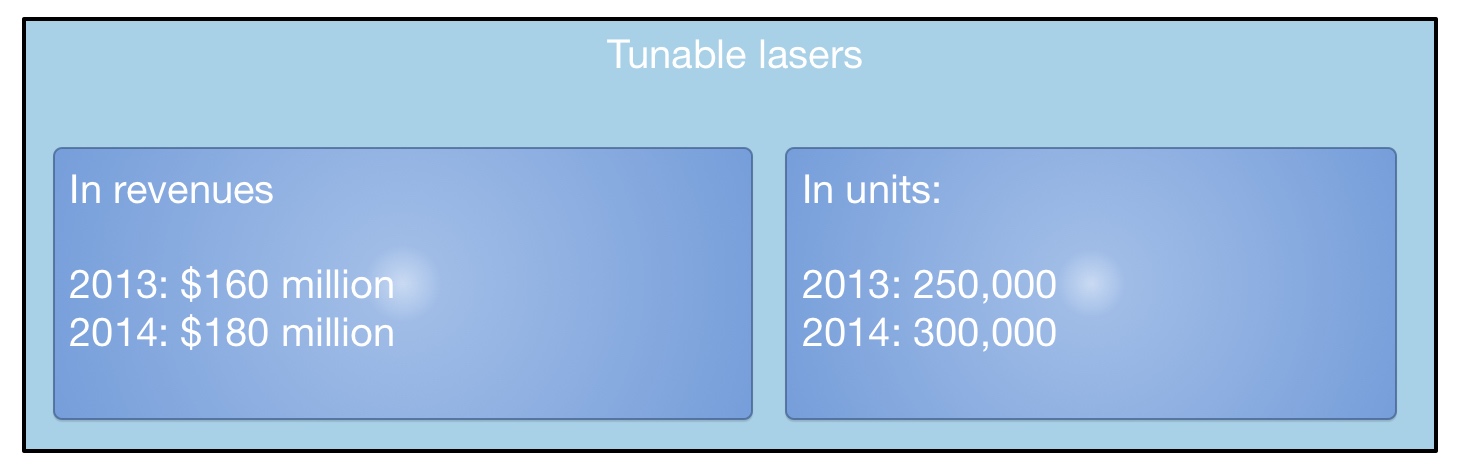

LightCounting valued the 2013 tunable laser market at $160 Million, growing to $180 Million in 2014. This equates to 250,000 units sold in 2013 and 300,000 units this year. "Most of these are for coherent systems," says Kozlov. The number of tunable lasers sold in modules - mainly XFPs but also SFPs and 300-pin modules - is 250,000 million units. "Half a million units a year; if you look at actual shipments, it is quite a lot," says Kozlov.

What next?

"I'm hoping we are reaching the low point in the tunable laser market as vendors are struggling and sales are at a very low valuation," says Kozlov.

The advent of more complex modulation schemes for 400 Gigabit and greater speed optical transmission, and the adoption of silicon photonics-based modulators for long haul will require higher powered lasers. But so much progress has been made by laser designers over the last 15 years, especially during the bubble, that it will last the industry for at least another decade or two, says Kozlov: "Incremental progress will continue and hopefully greater profitability."

For Part 1: NeoPhotonics to expand its tunable laser portfolio, click here