Vladimir Kozlov has been covering the optical components industry as an analyst since the optical boom of 2000. Here he reflects on the industry over the last decade.

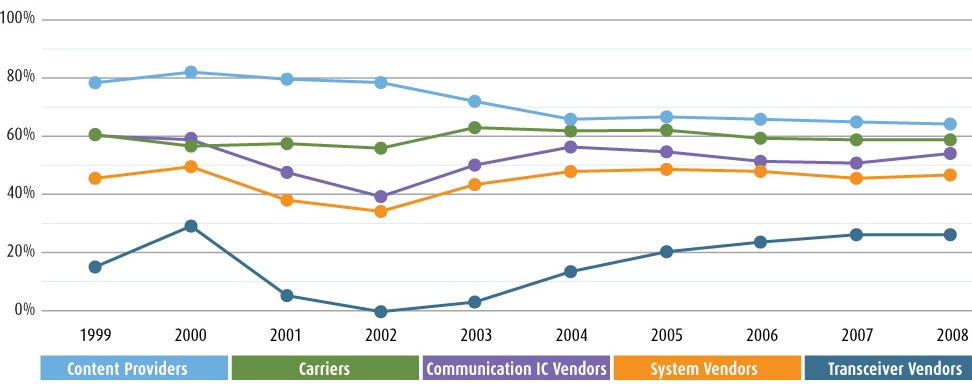

Average gross margin by industry. Source: LightCounting

Average gross margin by industry. Source: LightCounting

The biggest change in the last decade has been the way optics is perceived. That is the view of Vladimir Kozlov, boss of optical transceiver market research firm, LightCounting. “In 2000, optics was set to change the world,” he says. “The intelligent optical network would do all the work for the carrier; nothing would be done electrically.”

The boom of 1999-2000 saw hundreds of start-ups enter the market. Ten years on and a handful only remain; none changed the industry dramatically.

“The worse is definitely behind us”

“The worse is definitely behind us”

Vladimir Kozlov, LightCounting

Kozlov cites tunable lasers as an example. In 2000, the CEO of one start-up claimed the market for tunable lasers would grow to US$1 billion. Today the tunable laser market is worth several tens of millions. “It [the tunable laser] is a useful product that is selling but expectation didn’t match reality,” says Kozlov.

Another example is planar lightwave circuits used to make devices such as arrayed waveguide gratings used to multiplex and demultiplex wavelengths. “Intel was the biggest cheerleader,” says Kozlov. “Did planar lightwave circuits change the industry? No, but it is a useful technology.”

Where significant progress has been made is in the reliability, compactness and cost reduction of optical components. High-end lasers with complex control electronics have been replaced by small, single-chip devices that have minimal associated circuitry, says Kozlov.

Pragmatism not euphoria

The biggest surprise for Kozlov has been how many companies have survived the extremely tough market conditions. “There were almost no sales in 2001 and the market didn’t recover till 2004,” he says. Companies latched on to niche markets outside telecom to get by while many of the start-ups survived on their funding before folding, merging or being acquired by larger players.

“The leading companies such as Finisar, Excelight (now merged with Eudyna to form Sumitomo Electric Device Innovations), Avago Technologies and Opnext were also leading companies 10 years ago,” said Kozlov, who adds Oclaro, created with the merger of Bookham and Avanex.

The market has experienced hiccups since 2004 such as the dip of 2008-2009. “The worse is definitely behind us,” says Kozlov. Many vendors have a good vision as to what to do and plan accordingly. He notes companies are maintaining resources to be well placed to respond to rapid increases in demand. And profitability is rising sharply after the belt-tightening of 2008-09. “Whoever gets in first makes the profit,” says Kozlov. “That is what happened in 1999, although that was an extreme.”

Transceiver vendors and gross margins

Another notable development of the last decade has been the advent of optical transceivers. In the late 1990s system vendors such as Alcatel, Fujitsu, Marconi, NEC and Nortel designed their own optical systems before divesting their optical component arms. Optical component companies exploited the opportunity by developing optical transceivers to sell to the systems vendors.

LightCounting forecasts that the global optical transceiver market will total $2.2 billion in 2010, yet Kozlov still has doubts about the optical transceiver vendors’ business model. “Optical transceiver vendors still have to prove they are profitable and viable, that they are a real layer in the food chain.”

Comparing the gross margin performance of the industry layers that make up the telecom industry, optical transceiver vendors are last (see chart at the top of the page). Gross margin is an efficiency measure as to how well a vendor turns what they manufacture into income. Companies such as Cisco Systems have impressive gross margins of 75%. “You have to own a market, to have something unique to maintain such a margin,” says Kozlov.

Cisco has a unique position and to a degree so do semiconductors players which have gross margins twice those of the transceiver vendors. Contract manufacturers, however, have even lower margins than the 25% achieved by the transceiver vendors, adds Kozlov, but they benefit from large manufacturing volumes.

The main challenge for transceiver vendors is differentiating their products. There is also fierce competition across product segments. “A gross margin of 25% is not the end of the world as long as there are sufficient volumes,” says Kozlov. “And of course 25% in China is a lot – local [optical transceiver] vendors don’t think twice about entering the market.”

Kozlov says there are now between 20-30 Chinese optical transceiver vendors. “Some two thirds are benefiting from government funding but a third are building laser manufacturing and making transceivers, are real, and are here to stay.”

Bandwidth drives components

LightCounting collects quarterly shipment data from leading optical transceiver vendors worldwide. It also forecasts market demand based on a traffic model. Kozlov stresses the importance of the adoption of broadband schemes such as fibre-to-the-x (FTTx) as a traffic driver and ultimately transceiver sales.

A small change in the bandwidth utilisation of the access network has a huge impact on the network core. The advent of a killer application or the emergence of devices such as the iPhone and iPad that change user habits and drive access network utilisation from 2% to 5% would have a marked impact on operators’ networks. “This would require a significant upgrade and would result in a very nice bubble,” says Kozlov.

Utilised bandwidth (terabits-per-second). Scenario 2 with the higher utilisation in the access network quickly impacts core network capacity. Source: LightCounting

Utilised bandwidth (terabits-per-second). Scenario 2 with the higher utilisation in the access network quickly impacts core network capacity. Source: LightCounting

Another effect LightCounting has noted is that the total transceiver capacity is not keeping pace with growth in network traffic. This discrepancy is caused by operators running their networks more efficiently, explains Kozlov. Collapsing the number of platforms when operators adopt newer, more integrated systems is removing interfaces from the network.

LightCounting does not see operators’ traffic data such that Kozlov can’t know to what degrees operators are running their networks closer to capacity but given the rapid clip in traffic growth this is not a sustainable policy and hence does not explain this overall trend.

The next decade

Kozlov expects the next decade to continue like recent years with optical component companies being conservative and pragmatic. He is optimistic about optics’ adoption in the data centre as interface speeds move to 10Gbps and above, pushing copper to its limit. He also believes active optical cables are here to stay, while photonic integration will play an increasingly important role over time.

Kozlov also believes another bubble could occur especially if there is a need for more bandwidth at the network edge that will with a knock-on effect on the core.

But what gives him most optimism is that he simply doesn’t know. “We were all really wrong 10 years ago, maybe we will be again.”

- Lightwave July 2010: Interview with Vladimir Kozlov. "Can the optical transceiver industry sustain double-digit growth?